How to Open a Bank Account in Ireland (2025 Guide)

Opening a bank account is one of the first steps for newcomers, students, and workers settling in Ireland. It helps you receive your salary, pay bills, and build credit history. This quick guide explains which banks to choose, what documents you need, and tips to avoid delays.

🏦 Best Banks in Ireland for Newcomers

The main Irish banks are:

- AIB — popular, solid app, good student offers.

- Bank of Ireland — large branch network, trusted for expats.

- Permanent TSB — easy account opening, decent online banking.

- Revolut — not a traditional bank but offers fast mobile banking with Irish IBAN.

Tip: Traditional banks often need more documents. Revolut is good for a quick start, but a local branch account is often required for rent or student registration.

📑 Documents Needed to Open a Bank Account

Most banks require:

- Photo ID (passport or EU national ID card)

- Proof of Address in Ireland (utility bill, bank statement, or tenancy agreement)

- PPS Number — not always mandatory for all banks, but very common. See how to get yours here.

Students may also need:

- A student ID card or college registration letter.

✅ Step-by-Step: How to Open Your Account

1️⃣ Choose your bank — check branch locations near your home or college.

2️⃣ Gather documents — make sure your proof of address is less than 3 months old.

3️⃣ Book an appointment — many Irish banks require an in-person visit to verify your identity.

4️⃣ Attend your appointment — bring originals, not photocopies.

5️⃣ Activate online banking & debit card — most banks issue these within a few days.

💡 Can I Open a Bank Account Without a PPS Number?

Some banks may allow you to open a basic account without a PPS Number if you have strong proof of identity and address. However, most employers and landlords expect a PPS Number to match your bank details — it’s best to get it first.

💡 Bonus Banking Tips for Newcomers

- Compare student accounts: If you’re a student, some banks waive monthly fees and offer free debit cards — always ask about student offers.

- Watch for fees: Irish banks often charge maintenance fees or ATM fees. Read the small print so you’re not surprised.

- Online banking: Most banks now have solid apps — set up online banking and download your bank’s app on day one.

- International transfers: If you plan to send money home, check your bank’s rates and consider services like Wise or Revolut for cheaper transfers.

❓ Frequently Asked Questions

👉 Can I open an Irish bank account before arriving in Ireland?

Most traditional banks require you to be physically present with original documents. Some online banks like Revolut or N26 may allow you to open an account using your passport and proof of address abroad, but you may still need a local account later for rent or bills.

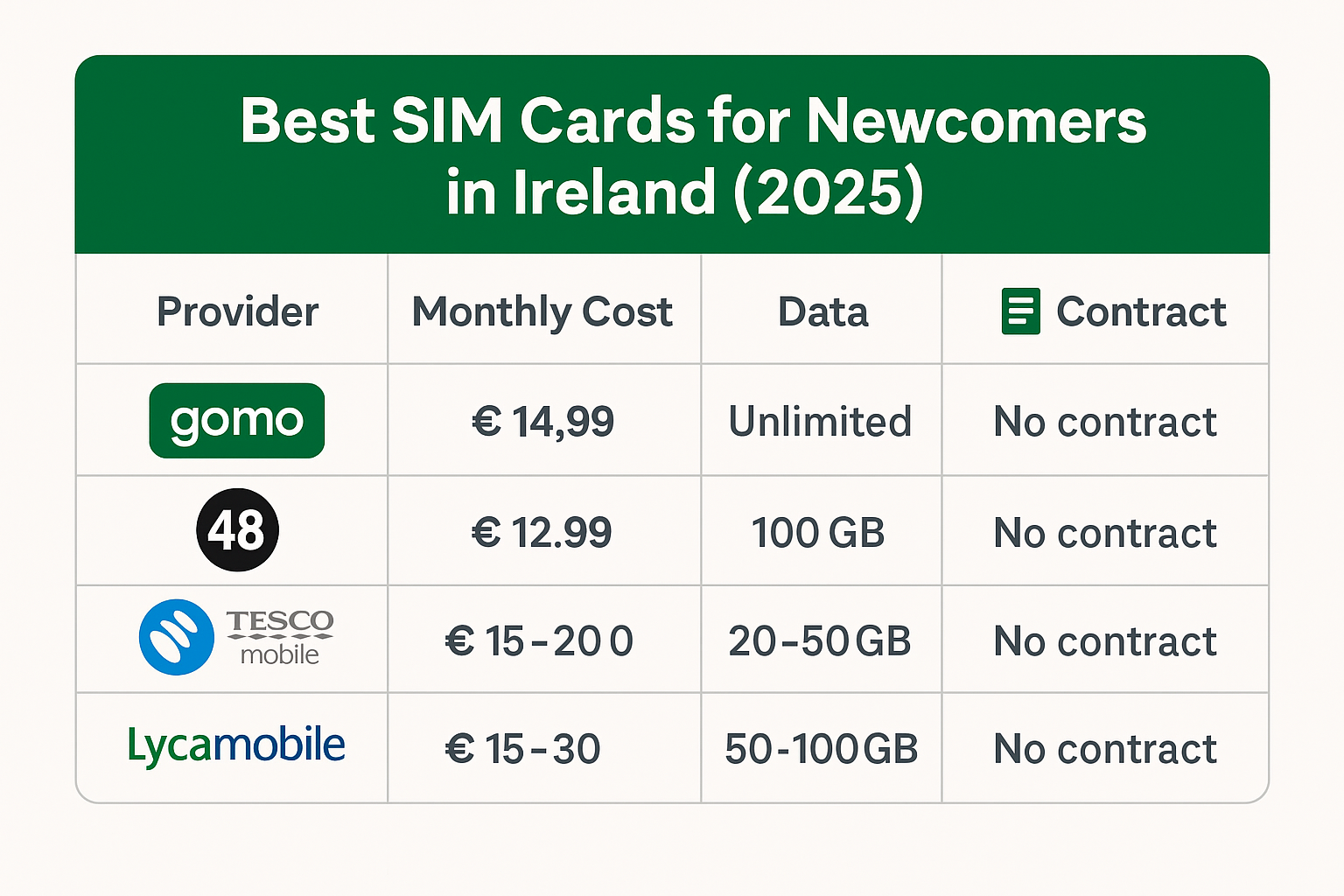

👉 Do I need an Irish phone number to open a bank account?

Not always, but it helps. Banks often send security codes by SMS. Get a local SIM card first — read our SIM Card Guide.

👉 Can I open multiple bank accounts?

Yes. Many newcomers use Revolut or N26 for quick spending and a traditional Irish bank for rent and salary deposits.

👉 How long does it take to get a debit card?

Most banks issue your debit card within 3–10 working days after you open your account and verify your identity.

🚀 Quick Tips

- Apply early — some banks have waiting times for appointments.

- Keep your PPS Number letter safe — you’ll need it for banking, tax, and more.

- Compare student accounts for perks like free banking and lower fees.

✅ Conclusion

Opening a bank account in Ireland doesn’t have to be stressful. Bring the right documents, book ahead, and you’ll be up and running in no time. Welcome to Ireland!

Need more help settling in? Check our step-by-step PPS Number Guide and Best SIM Cards in Ireland to get started right.